E-Signature Compliance Guide: GDPR, eIDAS, ESIGN, and UETA Explained Simply

Digital agreements have become an essential part of modern life, powering everything from client contracts and onboarding forms to medical consent and loan approvals. Signing documents online is faster, more secure, and more accessible than ever, but that convenience also comes with legal and ethical responsibilities. To make every signature count, it’s important to understand the global laws that make electronic signatures valid, private, and trustworthy.

Four major frameworks shape how electronic signatures are regulated and enforced around the world. GDPR (General Data Protection Regulation) governs how personal data is collected and protected during the signing process. eIDAS (Electronic Identification, Authentication and Trust Services) creates the foundation for legally recognized e-signatures across the European Union. In the United States, ESIGN (Electronic Signatures in Global and National Commerce Act) and UETA (Uniform Electronic Transactions Act) establish that digital signatures have the same legal weight as handwritten ones when key requirements are met.

These laws ensure that digital transactions are both efficient and legally secure. Understanding how they work not only helps organizations stay compliant but also strengthens trust between signers, clients, and partners in an increasingly paperless world.

Key Takeaways

Electronic signatures are legally valid worldwide as long as they meet core requirements: intent, consent, attribution, and document integrity.

ESIGN and UETA govern U.S. e-signatures, ensuring digital contracts hold the same legal weight as handwritten ones.

eIDAS regulates EU e-signatures, offering three assurance levels—Standard, Advanced, and Qualified—with QES carrying the highest evidentiary value.

GDPR focuses on protecting personal data within the signing process, requiring transparency, limited data use, and strong security measures.

Cross-border transactions must satisfy overlapping laws, making compliant platforms, audit trails, MFA, and secure storage essential for global legal enforceability.

Understanding Electronic Signatures

An electronic signature is any digital action that expresses a person’s agreement or approval of a document, whether it’s typing a name, clicking “I agree,” or drawing a signature on a screen. What defines its validity is not the method used but the elements that prove authenticity and intent.

Intent to sign: The signer must take a deliberate action that confirms agreement.

Consent to transact electronically: Both parties must agree to use electronic means for the transaction.

Attribution: The signature must be linked to the signer through identifiable information such as an email, timestamp, or authentication record.

Integrity: The signed document should remain unchanged once the signature is applied.

A digital signature, which uses cryptographic technology to verify identity and document integrity, represents a more advanced and secure form of electronic signature often used for highly regulated or high-value transactions.

United States Compliance Framework: ESIGN Act and UETA

The United States follows two major laws that define how electronic signatures are used and recognized: the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Together, these regulations ensure that electronic signatures carry the same legal weight as handwritten ones. The ESIGN Act applies at the federal level, while UETA provides consistent rules across most states, creating a unified legal foundation for electronic commerce and contracts.

Both laws were enacted to support the growing use of digital transactions while preserving fairness, consumer protection, and evidentiary integrity. Under these frameworks, a contract or agreement cannot be dismissed as invalid solely because it was executed electronically. What matters is that the signer showed clear intent and consent, and that the signature can be reliably attributed and retained.

Key Requirements for a Valid Electronic Signature

Intent to sign - The signer must take a clear and deliberate action that shows agreement, such as typing their name, selecting an “I accept” box, or signing with a stylus.

Consent to transact electronically - Both parties must agree to conduct the transaction electronically. For consumers, businesses must provide disclosures explaining their rights, including the ability to withdraw consent or request paper copies at any time.

Attribution and verification - A valid electronic signature must be linked to the signer through identifiable information such as an email address, timestamp, or authentication record, providing evidence of who signed and when.

Record retention - Signed documents must be stored securely and remain accessible for future reference, ensuring they can be reproduced in their original form if needed.

These requirements guarantee that every electronic signature is traceable, verifiable, and admissible in court, giving digital contracts the same legal protection as physical ones.

Practical Guidance for Businesses

Companies operating in multiple states should confirm that their e-signature solutions comply with both ESIGN and UETA standards. Most trusted platforms are designed to meet these requirements. Choosing providers that offer audit trails, encryption, and user verification further enhances legal reliability and protects against disputes.

Adhering to these principles not only ensures compliance but also builds confidence among clients and partners. A well-managed e-signature process shows that a business values transparency, accountability, and data integrity in every digital transaction.

European Union Compliance Framework: eIDAS Regulation

The Electronic Identification, Authentication and Trust Services (eIDAS) Regulation provides a unified legal foundation for electronic signatures across the European Union. It ensures that all electronic signatures, regardless of form, are legally recognized and admissible in court. Under eIDAS, no electronic signature can be dismissed simply because it is digital, giving businesses and individuals confidence when conducting cross-border electronic transactions.

Purpose of eIDAS

The eIDAS Regulation was introduced to create consistency and trust in electronic identification and authentication throughout the EU. Its main goal is to make it easier for individuals, companies, and public institutions to interact digitally across member states without needing separate national systems. By setting shared standards for identification and trust services, eIDAS helps ensure that an electronic signature in one EU country is recognized and valid in another.

The Three Types of Electronic Signatures

Standard Electronic Signature (SES) - A basic form of e-signature that includes simple actions such as typing a name in an email or clicking an approval box. It offers convenience for low-risk transactions but provides limited identity verification.

Advanced Electronic Signature (AES) - A more secure signature that is uniquely linked to the signer and capable of detecting any subsequent modification to the document. It uses encryption and digital certificates to confirm both the signer’s identity and the integrity of the file.

Qualified Electronic Signature (QES) - The highest and most secure level of electronic signature. It is created using a qualified signature creation device and issued by a certified trust service provider. A QES carries the same legal effect as a handwritten signature and benefits from a legal presumption of authenticity throughout the EU.

Compliance Essentials

Organizations that operate within the EU or handle transactions involving EU citizens must ensure that their e-signature processes meet eIDAS requirements. This includes:

Using verified trust service providers (TSPs) for advanced and qualified signatures

Maintaining comprehensive audit trails that record timestamps, signer identity verification, and document history

Ensuring that all signature data is tamper-evident and protected from unauthorized modification

Adhering to these standards strengthens legal defensibility and promotes transparency in digital agreements.

Looking Ahead to eIDAS 2.0

The next evolution of the regulation, known as eIDAS 2.0, will introduce a European Digital Identity Wallet that enables citizens and businesses to securely store and share digital credentials across borders. This system will make signing documents and verifying identity faster, more consistent, and fully interoperable within the EU. The update reflects a broader commitment to building a trusted digital ecosystem where convenience and compliance go hand in hand.

GDPR Compliance: Protecting Personal Data in Electronic Signatures

The General Data Protection Regulation (GDPR) is a cornerstone of data privacy in the European Union, setting strict standards for how personal information is collected, processed, and stored. In the context of electronic signatures, GDPR does not determine whether a signature is legally valid but governs how the personal data involved in the signing process is managed. This includes details such as a signer’s name, email address, IP address, and activity logs.

Every digital signature involves personal data, which means organizations must handle it transparently and securely. GDPR ensures that signers maintain control over their data while holding businesses accountable for protecting it. Compliance is not only a legal requirement but also a way to build trust by showing clients that their privacy is respected throughout the signing process.

Key GDPR Principles for Electronic Signature Workflows

Lawfulness and transparency - Organizations must have a clear legal basis for collecting and processing signer data and must inform individuals about how their information is used, stored, and shared.

Data minimization - Only collect the information necessary for the signing process. Avoid requesting personal details that are unrelated to the transaction.

Purpose limitation - Data gathered during signing should be used solely for that transaction and not repurposed for marketing or analytics without explicit consent.

Integrity and confidentiality - Signer data must be protected with strong security measures such as encryption, restricted access, and secure storage systems to prevent tampering or unauthorized access.

Accountability - Businesses must document how they comply with GDPR, maintain audit trails of signature events, and allow signers to access, correct, or delete their data upon request.

Practical Steps for Compliance

To ensure full alignment with GDPR when using e-signature tools:

Enter into a Data Processing Agreement (DPA) with your e-signature provider to define responsibilities and ensure proper data handling.

Conduct Data Protection Impact Assessments (DPIA) for large-scale or high-risk signing processes to identify and reduce potential privacy risks.

Select e-signature platforms that store data within the European Union or comply with recognized frameworks such as the EU–US Data Privacy Framework.

Proper GDPR compliance in electronic signatures goes beyond regulation. It demonstrates accountability, safeguards privacy, and builds long-term confidence between businesses and their clients in a digital-first world.

Global and Cross-Border Compliance

As businesses expand across regions, managing e-signature compliance becomes more complex. Each jurisdiction has its own legal framework, and ensuring that documents remain valid and enforceable in every location requires careful alignment between U.S. and European standards. Companies handling international agreements must confirm that their e-signature practices meet the requirements of ESIGN, UETA, eIDAS, and GDPR, as well as any local regulations that apply.

Consistency is key to maintaining legal recognition and trust in cross-border transactions. The most effective approach is to adopt tools and policies that satisfy multiple regulatory frameworks at once, creating a seamless signing experience for users around the world.

Strategies for Maintaining Global Compliance

Select a compliant e-signature provider

Choose a platform that explicitly supports compliance with ESIGN, UETA, eIDAS, and GDPR. Leading providers such as ROGER, Adobe Acrobat Sign, DocuSign, and Dropbox Sign maintain international certifications and integrate security protocols that meet both U.S. and EU standards.

Use multi-factor authentication (MFA)

Add an extra layer of identity verification by requiring multiple forms of authentication, such as email confirmation, one-time passcodes, or verified digital certificates. MFA reduces the risk of impersonation and strengthens the evidentiary value of each signature.

Maintain proper record retention

Store signed documents securely and keep them accessible for the legally mandated retention period in each jurisdiction. Proper archiving supports compliance audits and provides evidence in the event of disputes.

Follow international trust and security standards

Adopt frameworks like ISO 27001 for information security management and ETSI EN 319 for trust service providers. These standards promote uniform practices across borders and demonstrate a commitment to data integrity and secure authentication.

By integrating these practices, global organizations can create a unified, compliant e-signature process that respects both privacy regulations and legal recognition requirements, ensuring that every digital agreement stands up to scrutiny anywhere in the world.

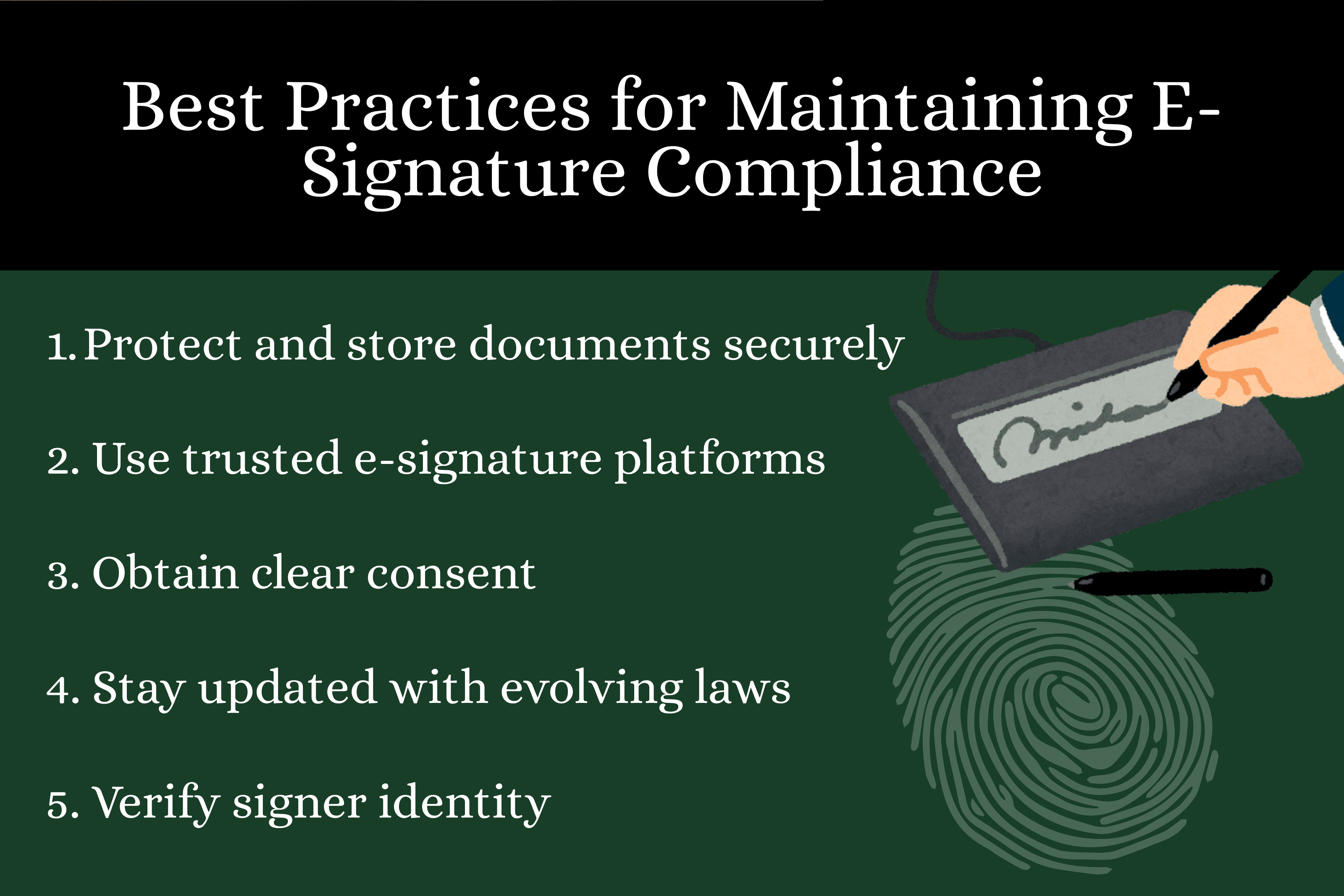

Best Practices for Staying Compliant

Maintaining e-signature compliance requires a combination of reliable technology, transparent communication, and ongoing security management. As regulations evolve, organizations must not only meet the minimum legal standards but also adopt practices that reinforce trust and accountability throughout the signing process.

Use trusted e-signature platforms

Choose providers with strong security features, audit trails, and encryption to document every signing event accurately.

Obtain clear consent

Make sure all parties understand and agree to sign electronically before completing any transaction.

Verify signer identity

Confirm identities through email, one-time passcodes, or digital certificates to prevent unauthorized signatures.

Protect and store documents securely

Encrypt all signed files, maintain backups, and ensure easy access for audits or legal reviews.

Stay updated with evolving laws

Review compliance policies regularly, especially as new standards like eIDAS 2.0 and AI-based verification systems emerge.

Common Misconceptions About E-Signatures

Despite how widespread digital signing has become, several myths still cause confusion about its legality and security. Understanding what the law actually says helps prevent mistakes that could invalidate an agreement or weaken its legal standing.

Typing your name is not valid - Typing your name can serve as a legitimate electronic signature if intent and consent are clearly established. What matters most is that the signer willingly approves the document and agrees to conduct the transaction electronically.

Electronic signatures are not secure - Modern e-signature platforms use encryption, authentication, and detailed audit trails to protect documents and verify signers. These safeguards often make electronic signatures more secure and traceable than paper-based alternatives.

All electronic signatures are the same - Not all electronic signatures carry the same legal authority. Under the eIDAS Regulation, there are three levels of assurance—Standard, Advanced, and Qualified—each offering different degrees of verification and evidentiary strength in legal proceedings.

Building Digital Trust Through Compliance

Electronic signatures have redefined how businesses manage contracts, close deals, and collaborate remotely. What truly gives digital agreements their strength is compliance with the right legal and security frameworks. Understanding how GDPR, eIDAS, ESIGN, and UETA work together ensures that every signature is valid, private, and legally enforceable across borders.

At ROGER, we simplify this process by combining security, transparency, and speed in one platform. Whether your team is sending NDAs, proposals, or client contracts, every document signed through ROGER complies with global e-signature laws and privacy standards.

If you have questions or want to make your signing process fully compliant, book a call with us. Our team at ROGER is here to help you build digital trust and move your business forward with confidence.

Frequently Asked Questions

1. Do GDPR, eIDAS, ESIGN and UETA all define electronic signatures the same way?

No. All four frameworks recognize electronic signatures as legally valid, but each sets its own rules. ESIGN and UETA focus on intent, consent and proper record retention. eIDAS creates three levels of signatures with different security requirements. GDPR governs how personal data in the signing process is collected and protected rather than how legally binding a signature is.

2. How do I know which law applies to my electronic signature?

The applicable law is determined by the location of the signer and the business. ESIGN and UETA cover transactions in the United States. eIDAS governs electronic signatures within the European Union. GDPR applies whenever personal data belonging to an EU resident is processed, even if the company is located outside the EU. International transactions often require compliance with more than one framework.

3. Is an electronic signature still valid if a document crosses both United States and European Union jurisdictions?

Yes, as long as the signature meets the strongest common requirements across both regions. This usually includes clear intent to sign, consent to transact electronically, reliable attribution, audit trails, tamper protection and full GDPR compliance for any personal data involved.

4. Does GDPR require businesses to get special consent before collecting signature data?

Yes. GDPR requires organizations to clearly inform signers how their personal data will be used, how long it will be stored and whether it will be shared. This data processing consent is separate from the signer’s consent to complete the transaction electronically.

5. Are Qualified Electronic Signatures required for every transaction in the European Union?

No. A Qualified Electronic Signature is only necessary for high risk or highly regulated agreements. Most common documents such as service contracts, onboarding forms and routine business agreements can be executed with Standard or Advanced Electronic Signatures as long as the signer’s identity and intent can be verified.